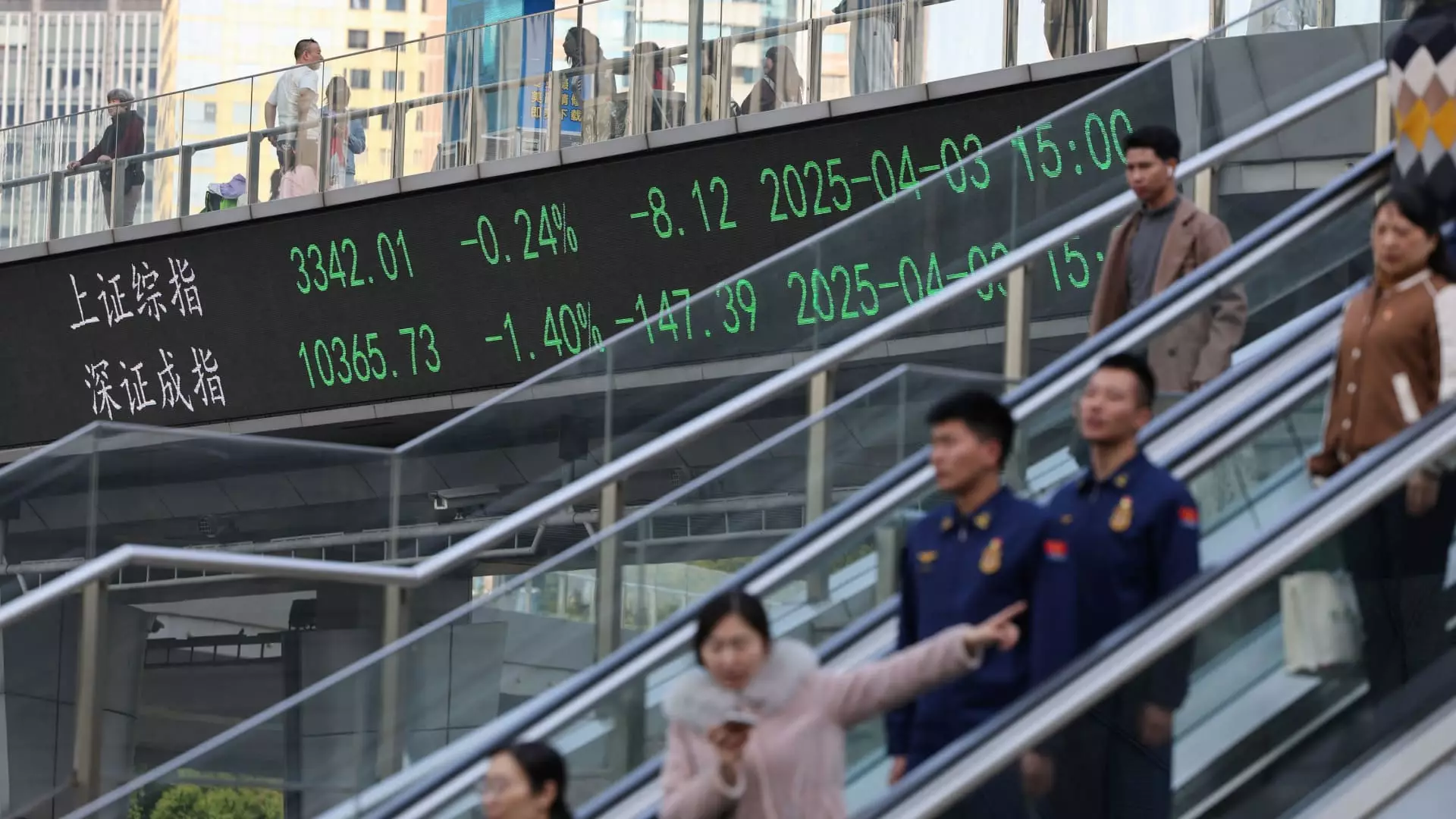

As global markets fluctuate with the introduction of new U.S. tariffs against China and its neighboring trading partners, the pulse of investor sentiment in China’s technology sector hangs in a delicate balance. While current trends suggest resilience amid adversity, the ramifications of these tariffs are far from trivial. Initial panic saw Chinese stocks plummet at the start of trading, raising alarm bells about the potential fallout. Yet, by the close, stocks had regained some ground, reflective of a type of market stubbornness that, while admirable, may hark back to a troubling trend: the willful ignorance of underlying risks.

Investors may feel emboldened by the projected growth in China’s generative artificial intelligence sector, but this enthusiasm should not overshadow the stark economic realities on the ground. What may seem at first glance like a minor market fluctuation may, in fact, reflect deeper socio-economic tremors that could reverberate far beyond the tech realm. Striking a balance between optimism and caution is paramount; failing to see through the haze of fleeting news cycles could lead to significant long-term consequences.

Governmental Intervention: A Double-Edged Sword

The Chinese government has hinted at possible fiscal intervention amid economic uncertainties. However, this suspension of belief that policy can magically uplift an economy is flawed at its core. Analysts like Kai Wang from Morningstar articulate optimism around government action, but a closer examination reveals an uncomfortable truth: frequent intervention often comes at the expense of market autonomy and can be politically motivated rather than economically sound.

Such state interventions might deliver short-term relief, but they can also stifle innovation and lead to complacency among businesses that feel cushioned by government support. If these measures are merely knee-jerk reactions to market volatility, they can inhibit genuine growth and deter domestic and international investments in the long run. Therefore, while policymakers may hold a vested interest in presenting a stable economic picture, the potential for negative consequences looms large, leading to an erosion of investor confidence rather than its reinforcement.

Tech Stocks: A False Sense of Security

Many observers tout the relative affordability of Chinese tech stocks in comparison to their U.S. counterparts, with the valuation gap appearing enticing from a distance. Yet, it’s crucial to question this narrative of “bargain stocks” amidst economic headwinds and external pressures—would you invest in a brand simply because it’s cheaper, especially when the quality of the product is under scrutiny?

Analysts at Citi point to this disparity, advocating for investments in Chinese internet and technology companies. However, the underlying rationale raises valid concerns about whether these stocks can sustain their growth trajectories amid mounting trade tensions and uncertainties regarding future regulatory actions. The alluring price-to-earnings ratios do little to mitigate fears surrounding tariff implications and market volatility. The market’s ability to bounce back sharply from short-term dips should not lend credence to the notion that sustained growth is guaranteed—an outlook that veers dangerously close to wishful thinking.

AI Potential vs. Geopolitical Restrictions

The burgeoning interest in generative artificial intelligence is certainly noteworthy, with Chinese companies showcasing ambitious projects aimed at competing on a global stage. Despite constraints on access to advanced technology, firms like DeepSeek are making strides, asserting claims of outperforming competitors like OpenAI’s ChatGPT.

However, the potential for innovation must be viewed through the prism of geopolitical realities. U.S. restrictions on advanced chips for training AI exacerbate an already volatile environment. When a sector is poised for growth yet constrained by external forces, how much confidence can investors reasonably place in its future? The allure of rapid advancement must be juxtaposed against the precarious nature of international relations and tech sector health—a challenging balance to strike.

The Healthcare Sector: An Unfounded Refuge?

With the tech sector under scrutiny, attention has shifted to China’s healthcare industry as a possible haven for worried investors. Analysts suggest that pharmaceuticals are relatively insulated from tariff ramifications. Yet, this assumption may overlook the broader implications of economic instability on healthcare investments.

While biotech firms may have U.S. partners, the inflation in drug prices and ongoing bipartisan support for cost-efficiency may present substantial hurdles. Allegedly safe bets like Wuxi Biologics might not be the unyielding sanctuary investors hope they are. Though the company anticipates “accelerated and profitable growth,” the shifting legislative landscape could undermine those projections significantly.

In an economic climate rife with uncertainty, the belief that the healthcare sector is shielded from external pressures is overly optimistic. The loyalty of traditional investors to healthcare stocks in times of crisis often overlooks the interconnectedness of markets and the potential ripple effects of governmental policy decisions.

The current climate necessitates a careful re-evaluation of investment strategies in China’s tech and healthcare sectors, one that accurately contemplates the numerous variables at play. Only time will tell just how much longer the illusion of stability can persist.