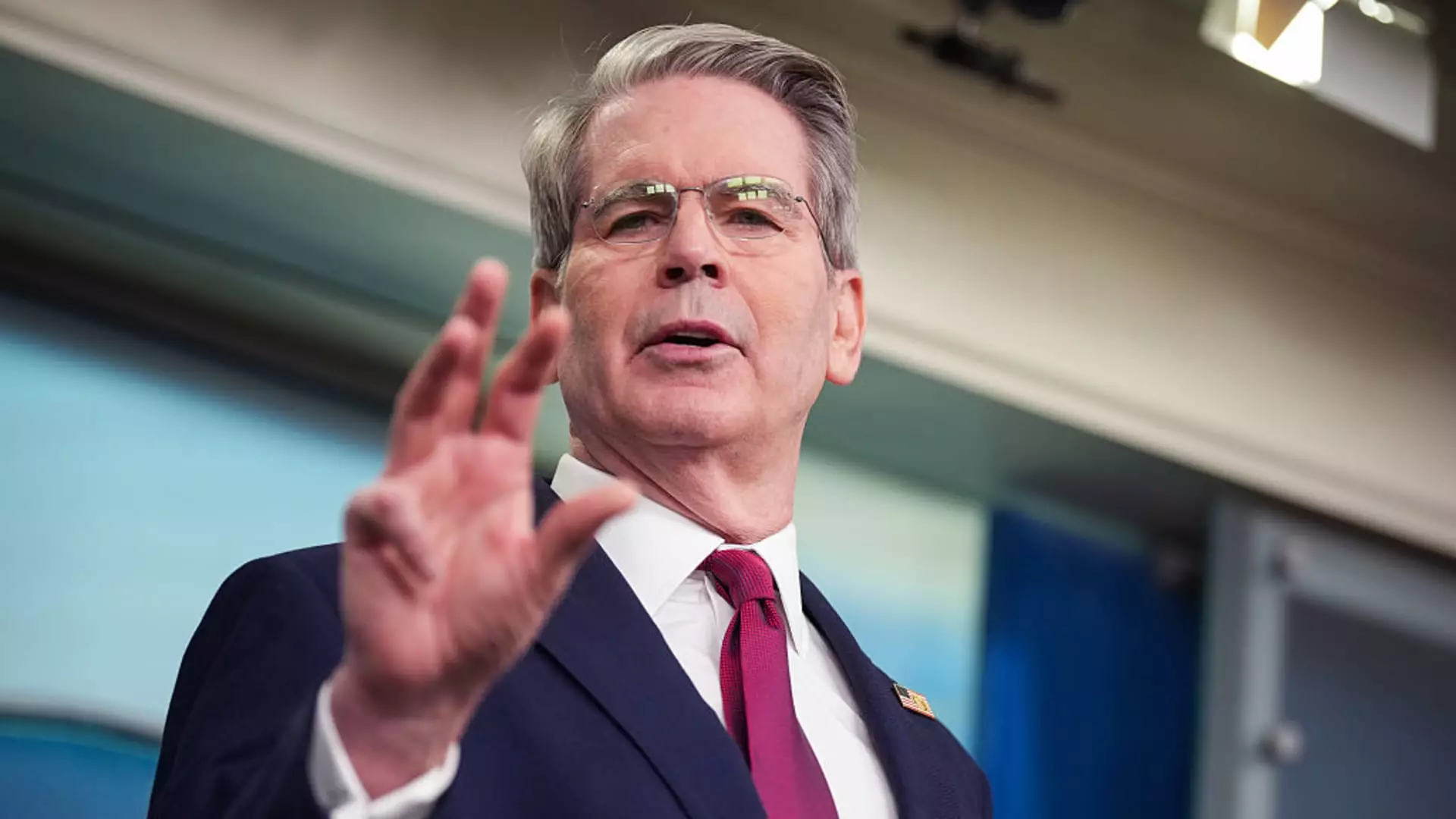

In the face of a tumultuous market characterized by volatility and uncertainty, individual investors have exhibited remarkable steadfastness. Treasury Secretary Scott Bessent recently emphasized this unique dynamic, revealing that an astonishing 97% of Americans have refrained from trading in the past 100 days, even as the markets teetered dangerously close to bear territory. This suggests a profound level of trust in President Trump’s tariff policies and the overall direction of the economy, starkly contrasting with the anxiety gripping institutional traders. The ordinary American investor appears to be weathering the storm, holding firm to their convictions while their institutional counterparts scramble for stability.

The Diverging Strategies of Investors

The behavior of individual and institutional investors diverges sharply under current conditions. Professional traders have been quick to panic, pulling their resources and betting against the market as fears of a recession stir. However, it’s precisely this panic that amplifies the fear of an economic downturn. Retail investors, on the other hand, have taken advantage of the market dips, buying stocks that they believe are undervalued and positioning themselves for future growth. This behavior reflects a strategy built on conviction rather than reactionary tendencies—a notable advantage amidst fear-driven behavior prevalent within institutions.

The Realities of Tariff Policies

While the steadfastness of individual investors may seem commendable, it also raises critical questions about the sustainability of their optimism. The recent suspension of significant tariffs could be viewed as a necessary measure to curb a burgeoning economic crisis, but it also reflects the unpredictable nature of Trump’s trade policies. Many economists, like Torsten Slok from Apollo, warn that the repercussions of these tariffs will soon manifest as shortages on store shelves, potentially redefining consumer behavior and, by extension, leading the economy into recession. Viewing this through an analytical lens, one might argue that this policy-induced anxiety could be detrimental to the American economy in the long run.

The Danger of Misleading Confidence

The precarious situation where confidence is upheld by individual investors may be misleading. While their collective trust in Trump’s policies could suggest a stable economic environment, the reality is far more nuanced. As hedge funds and seasoned investors retreat, the traditional wisdom in trading strategies is sidelined, potentially leaving retail investors exposed. Ken Griffin of Citadel highlights concerns that such a trade conflict could tarnish America’s global standing. As these geopolitical ramifications loom larger, the supporters of President Trump might do well to critically evaluate their beliefs rather than hold fast just for the sake of loyalty.

Braving the Economic Storm

As individual investors remain resolute, they embody a broader narrative of resilience amid economic storms. However, a careful consideration of market fundamentals is paramount. One cannot ignore the warning signs of potential trade-related repercussions that could destabilize consumer confidence and ultimately hinder economic growth. In a climate laden with uncertainty, trusting one’s instincts is vital, yet it is equally important to adopt a grounded perspective based on market realities rather than just faith alone. The journey of the U.S. economy will depend on how these players navigate through and react to the shifting sands of policy and global trade challenges.