Samsung Electronics stands at a crucial juncture, gearing up to enhance its on-device artificial intelligence (AI) capabilities in a bid to surpass the expected modest growth of the global consumer electronics market. With a projected increase of approximately 3% for the smartphone, television, and home appliances market in 2025, Samsung has set ambitious growth targets for its own mobile device sector, aiming for a 4% to 5% rise in the same timeframe. This strategic pivot reflects the company’s recognition of the need to innovate and adapt in a continually evolving tech landscape.

As the leading manufacturer of smartphones and televisions worldwide, Samsung is committed to leveraging AI in its product range. The company has been making significant investments to incorporate AI chips across various devices, including refrigerators, washing machines, and robot vacuums. This move is not merely about keeping up with trends; it is about reshaping the consumer experience to provide smarter, more interconnected appliances. The recent advancements in AI capabilities, particularly in the Galaxy S24 series, showcase features like real-time translation for foreign language calls, highlighting Samsung’s dedication to enhancing user convenience.

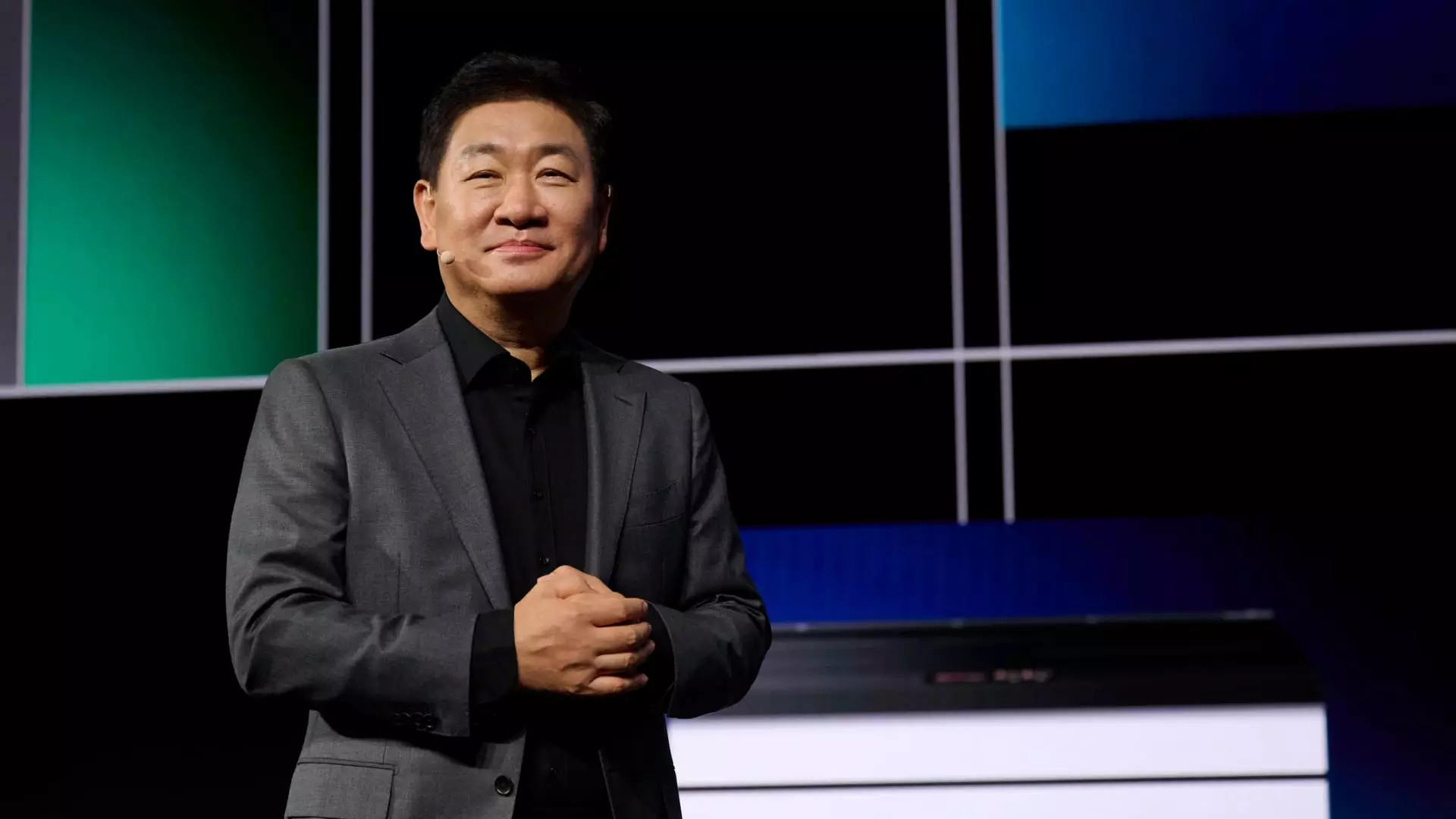

Despite its technological prowess, Samsung faces intense competition from emerging Chinese brands such as Huawei and Xiaomi. These companies are increasingly gaining market share by offering high-quality smartphones at reduced prices. In interviews, Jong-Hee Han, Samsung’s CEO, has characterized this competitive environment as “helpful,” suggesting that competition drives innovation, ultimately benefiting consumers. Samsung’s strategy is clear: rather than simply lowering prices, they aim to differentiate their products by emphasizing security, convenience, and enhanced features powered by AI.

In parallel to its product advancements, Samsung has undergone a significant leadership restructuring, appointing Jun Young-hyun as co-CEO, alongside Han. This shift aims to reinforce the company’s focus on its memory chip division, which is vital for staying competitive in the high-bandwidth memory (HBM) space. Samsung, once the undisputed leader in memory chips, is now striving to regain ground lost to rivals such as SK Hynix, particularly in relation to components essential for AI applications. The pressure is on leadership to innovate and respond to market demands swiftly.

The financial health of Samsung is under scrutiny, especially following a disappointing third-quarter performance, which prompted Jun to issue a rare public apology. Analysts predict that Samsung’s operating profit for the December quarter will rebound to approximately 8.2 trillion won, up from a year prior but still below previous quarters. This highlights the volatility and challenges Samsung faces in maintaining its industry position amid fluctuating market conditions. In 2022, shares suffered a substantial decline, contrasting with broader market trends, underlining the necessity for robust strategic initiatives.

In response to investor concerns, Samsung has unveiled a “value-up” plan aimed at enhancing shareholder returns, which will be rolled out gradually. This approach signifies a shift towards prioritizing investor relations and stabilizing stock prices, particularly after a staggering 32% drop in share prices last year. The announcement of a 10 trillion won share buyback illustrates Samsung’s commitment to building investor confidence, although caution remains prevalent regarding ongoing market headwinds.

As Samsung Electronics charts its future, the successful integration of AI in its devices and a strategic focus on shareholder value could define its trajectory in the coming years. Though facing fierce competition and financial uncertainties, the company’s commitment to innovation, coupled with a clear vision for enhancing user experience, positions it well for potential growth. The next steps in navigating the complexities of the market will be crucial as Samsung aims to solidify its leadership in an increasingly competitive landscape, ensuring that it does not just keep pace but leads in consumer electronics innovation.