In a surprising turn of events, the Consumer Financial Protection Bureau (CFPB) has found itself grappling with significant operational disruptions. Employees were instructed on Sunday to work remotely as the bureau’s Washington, D.C. headquarters will remain closed through February 14. This news came via a memo from CFPB Chief Operating Officer Adam Martinez, which followed an earlier email from acting CFPB director Russell Vought. Vought’s message directed staff to halt nearly all agency activities, including oversight of financial institutions. This unprecedented suspension raises questions about the CFPB’s future and its essential role in consumer protection.

The Impact of Leadership Changes

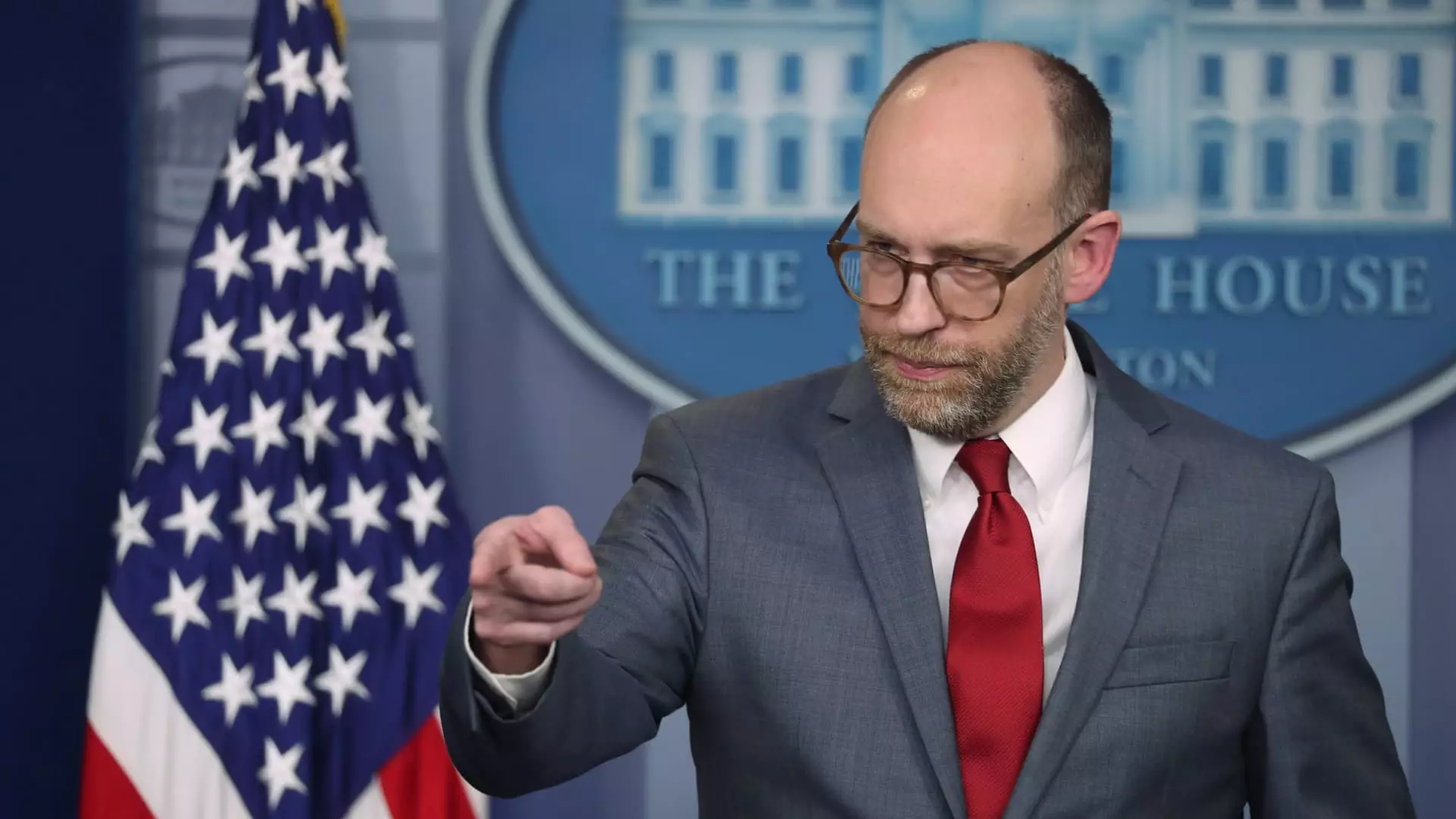

The changes at the CFPB coincide with the new leadership of Russell Vought, who was recently confirmed as the head of the Office of Management and Budget under President Donald Trump. Vought is associated with Project 2025, an ambitious initiative aimed at restructuring the federal government. In his first actions as acting director, he has not only stopped the flow of funding to the CFPB but also restricted its operations significantly. Vought characterized this funding freeze as a necessary measure to curb what he described as the agency’s unaccountability, aligning with a broader political narrative that questions the CFPB’s legitimacy and effectiveness.

The CFPB’s operations have been further complicated by the involvement of Elon Musk’s operatives—affectionately dubbed “DOGE.” Reports indicate that personnel associated with Musk have gained access to sensitive CFPB data, including employee performance reviews. The implications of this access are troubling, raising concerns about data security and the potential for conflicts of interest. Adding to the uneasy atmosphere, Musk has publicly expressed disdain for the agency, even posting “CFPB RIP” on social media, which underlines the precariousness of the CFPB’s situation.

Job Security and Agency Viability

With approximately 1,700 employees, the CFPB faces an uncertain future regarding job security. Sources within the bureau suggest that many employees fear being placed on administrative leave or even laid off. Notably, only a fraction of these positions are mandated by law, making the agency particularly vulnerable to mass layoffs. The potential reduction of staff poses a significant threat to the CFPB’s mission, which was established to protect consumers from unscrupulous practices in the financial sector after the 2008 financial crisis.

If the CFPB’s capabilities are further diminished, numerous efforts aimed at safeguarding consumers could be jeopardized. The agency has been instrumental in implementing regulations to limit excessive fees and protect consumers from detrimental practices. For instance, proposed measures to curb credit card and overdraft fees have the potential to save consumers tens of billions of dollars. Furthermore, a significant rule aimed at erasing $49 billion in medical debts from the credit scores of millions is at risk of being abandoned.

As the CFPB navigates this tumultuous period, the ramifications of these changes could have lasting effects on consumer protection in the United States. The combined uncertainty from leadership shifts, operational restrictions, and potential job cuts reflects a worrying trend for the agency, which was created to ensure fairness and transparency in the financial industry. The coming weeks and months will be critical in determining whether the CFPB can maintain its core functions or if it will succumb to external pressures aimed at dismantling it.