Nvidia, the once-crowned king of AI computing, is finding itself increasingly cornered as geopolitical realities take center stage in the tech industry. The announcement of a staggering $5.5 billion quarterly charge due to export restrictions on its H20 graphics processing units (GPUs) to China is not just a mere financial footnote; it signals a seismic shift in Nvidia’s operational landscape. The stock’s subsequent 6% dip in extended trading is emblematic of investor anxiety regarding the company’s future viability.

The landscape has changed dramatically since President Biden’s administration implemented tighter export controls, raising critical questions about the sustainability of Nvidia’s unprecedented growth. These measures, purportedly designed to prevent advanced AI technologies from bolstering military capabilities in adversarial nations, threaten to stifle innovation rather than promote it. The U.S. government now requires licenses for Nvidia’s H20 chips to enter China, a market that once offered exponential revenue potential.

A Linked Future in Limbo

Nvidia’s H20 is not just another chip; it stands on the shoulders of advanced AI architecture tailored for compliance with U.S. regulations yet still falls short against its U.S. contemporaries like the H100 and H200. This positioning reflects a broader dilemma: how to balance compliance with the U.S. government’s protective stance while still competing effectively in a rapidly evolving global marketplace. In an ironic twist, Nvidia now faces heightened competition from Chinese firms like DeepSeek, who are leveraging Nvidia’s technology for their gain. The grim reality is that exports shrank to an appalling half of pre-control revenue levels, indicating a loss of influence in a market that is pivotal for the company’s future.

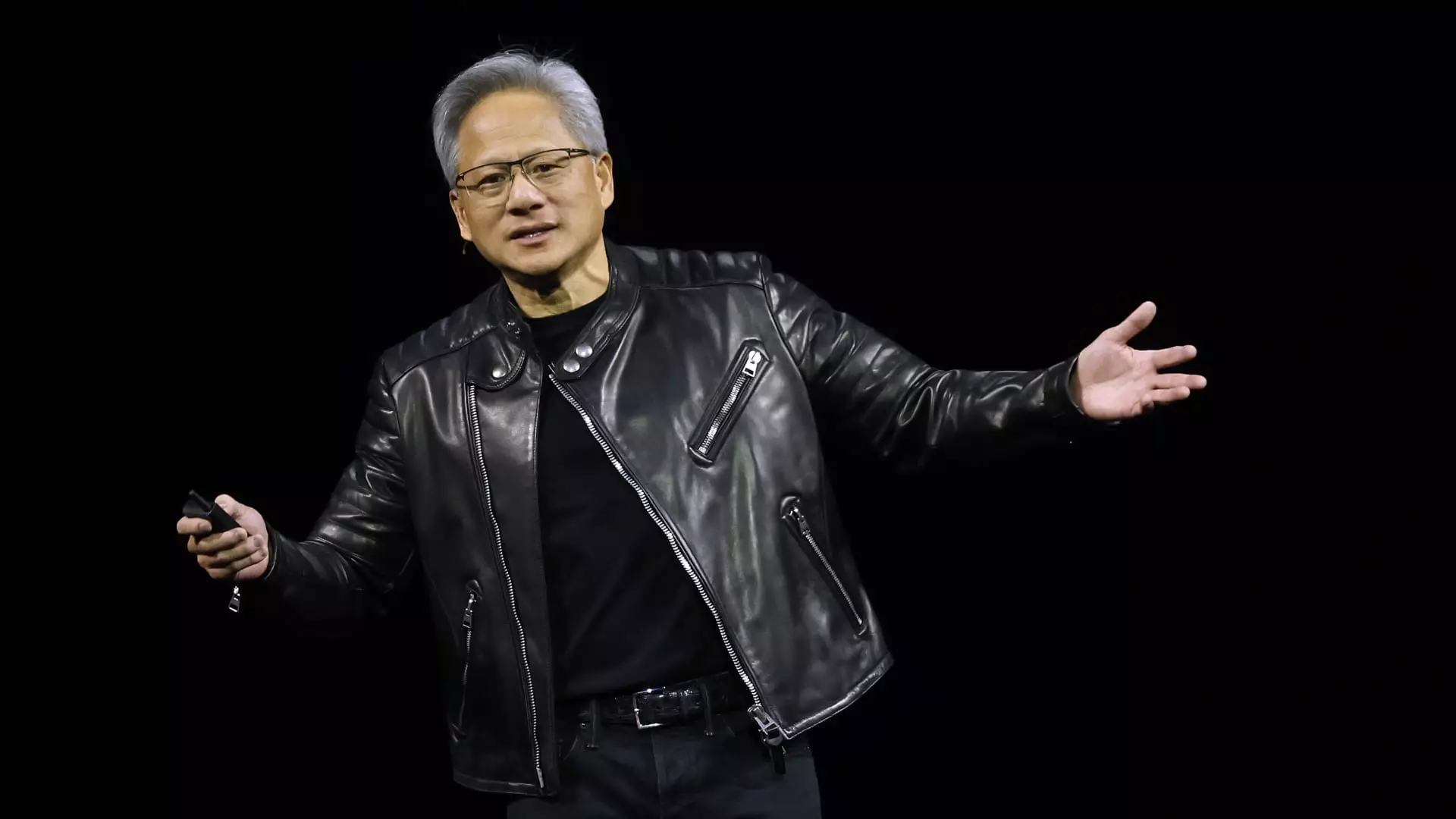

The revenue stream anticipated from H20—estimated at $12 billion to $15 billion for 2024—now feels like a mirage fading before our eyes. Instead, as Nvidia CEO Jensen Huang noted, half of the world’s AI researchers are now based in China, many collaborating within U.S. soil. This paradox raises crucial questions about whether the U.S. can afford to isolate itself from a significant talent pool, especially given the speed with which technology evolves.

Implications for America’s Tech Ecosystem

The ramifications of these export restrictions extend well beyond Nvidia’s corporate tallies. Curbing exports under the camouflage of national security could inadvertently hamstring U.S. innovation, pushing companies to relocate R&D efforts to more hospitable environments. This scenario poses a dire threat not just to Nvidia but also to America’s broader technological edge. As rival nations continue to invest heavily in AI, placing stringent limits on exportation could erode the competitive standing that U.S. firms once enjoyed.

Moreover, Huang’s warnings about increasing competition are alarming. With firms like Huawei positioning themselves as formidable challengers, the U.S. risks transforming its once-dominant tech landscape into one that is reactive rather than proactive. The narrative of competition transforms from a localized race to an international battle where American firms may find themselves at a disadvantage if they’re not allowed to operate freely within critical markets.

Regulatory Myopia?

When scrutinizing the U.S. government’s licensing requirements and their timing, one cannot help but question the overarching strategy underpinning these moves. Is America truly willing to sacrifice its leadership in AI under a veil of cautious patriotism? It appears that in its bid to maintain national security, policymakers are crafting a strategy that could risk alienating key allies and stifling homegrown innovation.

By imposing the indefinite license requirement for H20 chips, Washington may have inadvertently drawn a line in the sand that diminishes the U.S.’s stature in the global tech landscape. The objective of maintaining technological supremacy is noble; however, the execution appears myopic at best. A collaborative framework, rather than sheer containment, might yield more favorable outcomes as nations grapple with the rapid technological flux affecting the global economy.

As Nvidia stands at this critical juncture, one must ponder whether its storied legacy can endure in an era marred by restrictive policies that inherently contradict the very nature of innovation—opening doors rather than barricading them.